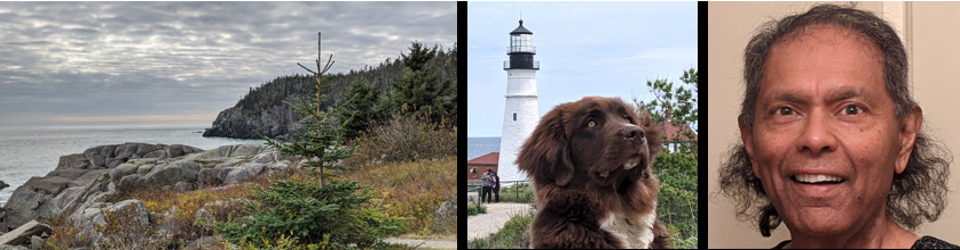

by Anura Guruge

on August 29, 2024

I guess most of today’s market commentator’s aren’t old enough to remember Cisco. I am old enough plus I was very intimately associated with Cisco in its glory days. So, yes, I owned CSCO ahead of 2000 and into around 2004. So YES I saw it spike up & come crashing down.

Cisco was the DARLING of the emerging Web. Just like Nvidia is the DARLING of the AI brigade. Cisco could do no wrong. It totally dominated Internet networking. Cisco was the king of routers.

And then it crashed. In the last two decades it has clawed itself back into the market. But, its stock price, even today, is basically 1/2 what it was at its high.

NVDA reminds me of this.

Did I learn from CSCO. Heck no. I rode CSCO up and was too scared to sell. Ditto NVDA. This is why I am poor. I don’t know when to sell. SMILE. But, I am used to being poor.